LCI Mensuel – Ce qui a marqué Février 2026

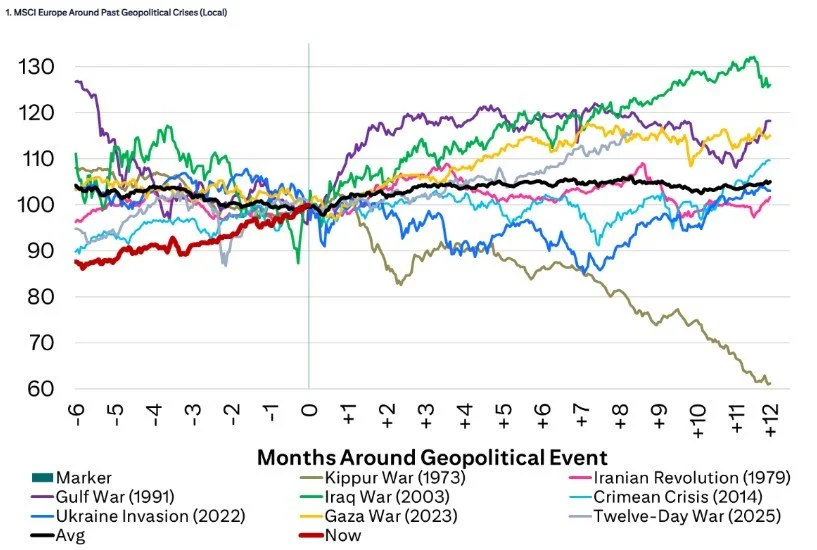

L’intelligence artificielle bouleverse l’industrie du logiciel, comprimant les marges et remettant en question les modèles économiques traditionnels. Parallèlement, tensions géopolitiques, évolutions monétaires, conflits commerciaux et chocs énergétiques transforment le paysage économique mondial. Les marchés font face à des mutations structurelles en technologie, géopolitique et équilibres de puissance.

LCI Mensuel – Ce qui a marqué Janvier 2026

Le début de 2026 est marqué par une montée des tensions géopolitiques, des recompositions commerciales et des pressions institutionnelles. De l’intervention américaine au Venezuela aux inquiétudes sur l’indépendance des banques centrales, la politique mondiale et l’économie sont de plus en plus dominées par la coercition, la rivalité stratégique et la fragilité des alliances.

LCI Mensuel – Ce qui a marqué Décembre 2025

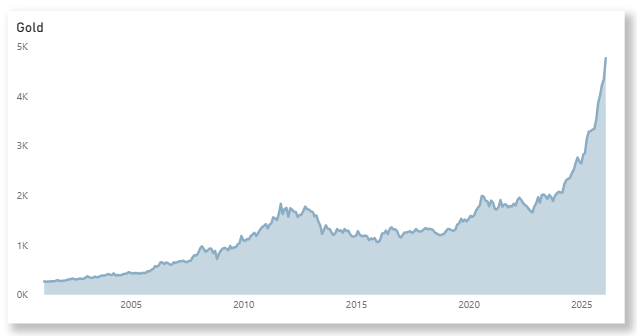

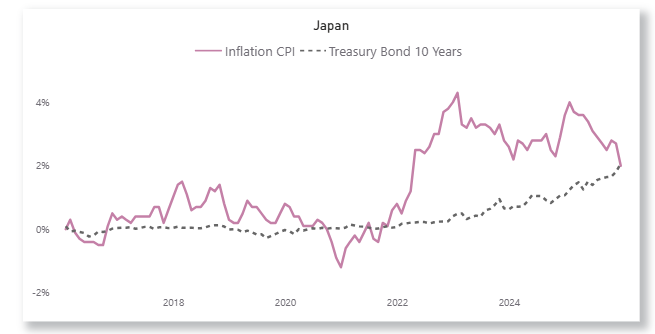

L’année 2025 a été marquée par la montée des tensions commerciales, l’évolution des équilibres géopolitiques, l’adoption de l’IA et la résilience des marchés financiers. La hausse des droits de douane américains, la domination exportatrice de la Chine, le recentrage des priorités sécuritaires et la normalisation monétaire au Japon ont façonné un environnement mondial complexe, tandis que les marchés actions ont enregistré de solides performances, dépendantes des devises.

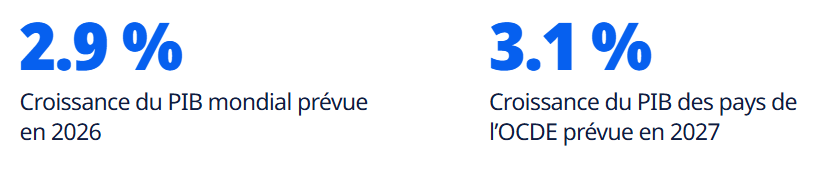

Perspectives économiques de l'OCDE, Décembre 2025

Les Perspectives économiques de l’OCDE de décembre 2025 décrivent une croissance mondiale résiliente mais de plus en plus fragile. Le ralentissement attendu, les tensions commerciales et l’affaiblissement progressif des marchés du travail constituent des risques clés pour les investisseurs. L’inflation recule vers les objectifs des banques centrales, tandis que les réformes structurelles restent essentielles pour soutenir la croissance à long terme.

LCI Mensuel – Ce qui a marqué Novembre 2025

Les marchés mondiaux évoluent au rythme de développements politiques et économiques majeurs : fin du plus long shutdown gouvernemental aux États-Unis, baisse de tarifs douaniers, accord commercial historique avec la Suisse, envolée de Nvidia portée par l’IA, croissance chinoise en repli et attentes croissantes d’une baisse des taux en décembre.

LCI Mensuel – Ce qui a marqué Octobre 2025

L’activité économique mondiale s’est renforcée en octobre, l’Allemagne et les États-Unis menant la reprise mondiale. L’inflation est montée à 3 % aux États-Unis, tandis que les difficultés des banques régionales refaisaient surface. La Chine a resserré ses exportations de terres rares, les États-Unis ont sanctionné les géants pétroliers russes, et le Japon a élu sa première Première ministre, dans un contexte mondial en mutation.

La fin de l’ESG

L’ESG n’est pas mort : il évolue. Découvrez comment Alex Edmans redéfinit l’investissement environnemental, social et de gouvernance comme moteur de valeur durable.

LCI Mensuel – Ce qui a marqué Septembre 2025

Septembre 2025, Un mois mouvementé en politique et économie mondiales : Trump annonce 100 % de droits de douane sur les médicaments et renchérit les visas, tandis que la Fed baisse ses taux sous pression. La France perd son Premier ministre, la Russie frappe l’Otan, la Suisse signe avec le Mercosur et l’or atteint un record.

OECD Economic Outlook – Septembre 2025

La croissance mondiale est demeurée résiliente au premier semestre 2025, portée par plusieurs marchés émergents et les États-Unis. L’anticipation du relèvement des droits de douane américains (portés à 19,5 % fin août, un plus haut depuis les années 30) a stimulé production et échanges, mais commence à peser sur la consommation, l’emploi et les prix. Si la désinflation s’est stabilisée, l’inflation des services et la hausse des prix alimentaires persistent. Les risques demeurent élevés : nouvelles hausses tarifaires, pressions budgétaires, regain inflationniste ou corrections financières. À l’inverse, un allègement des restrictions commerciales ou des avancées rapides en IA pourraient améliorer les perspectives.

LCI Mensuel – Ce qui a marqué août 2025

En août 2025, la pression politique sur la Fed américaine s’est accentuée et un vote de confiance imminent en France a ébranlé le sentiment des investisseurs. Alors que les rendements à 10 ans de la zone euro sont restés stables, les spreads de crédit aux États-Unis sont demeurés serrés, soutenus par la demande pour les entreprises de haute qualité. Les actions mondiales ont progressé modestement, menées par les marchés émergents asiatiques et les économies riches en ressources.

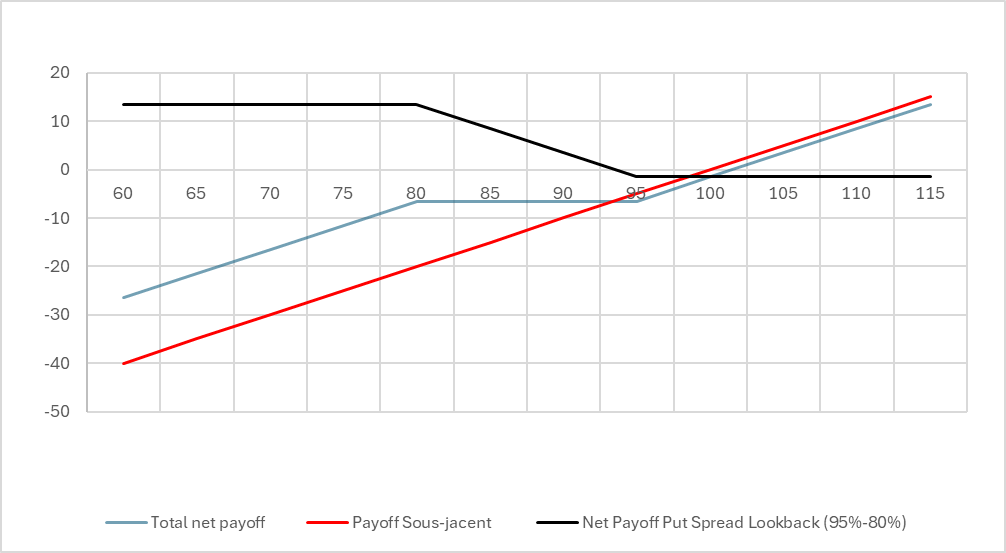

Trop de défis pour les marchés boursiers : La Côte Invest commence à couvrir 50 % de son exposition en actions

Face aux incertitudes économiques mondiales, La Côte Invest prend des mesures proactives en couvrant 50 % de son exposition en actions. Cette décision stratégique implique la mise en place d’une stratégie de Put Spread avec une fonctionnalité de rétroaction pour protéger le portefeuille contre les baisses du marché.

LCI Monthly – What Shaped July 2025

U.S. inflation rose to 2.7% in July, keeping Fed rates steady at 4.25–4.50%. Trump escalated trade tensions with new tariffs, while markets rebounded, led by Nvidia surpassing $4 trillion. Spain faced tourism strikes, and England’s Lionesses clinched the UEFA Women’s Euro 2025 in Basel.

LCI Monthly – What Shaped June 2025

June was shaped by Middle East tensions, a sharp but short-lived oil price spike, and diverging central bank paths, with the Fed on hold and the ECB cutting rates. Trump’s renewed attacks on Powell pressured the dollar, while the BIS warned of rising global fragility. A 90-day US-China tariff truce brought only temporary relief to markets.

OECD Economic Outlook – June 2025

The global economic outlook is deteriorating, with rising trade barriers, policy uncertainty, and tightening financial conditions threatening growth. Inflation risks remain high, driven by trade disruptions—though lower commodity prices may offer some relief. A reversal in trade tensions could provide a much-needed boost.

LCI Monthly – What Shaped May 2025

May 2025 saw a shift in the global landscape: the U.S. economy contracted, Moody’s downgraded U.S. debt, and trade tensions eased with delayed tariffs. Equity markets rallied, especially in Europe and North America. Friedrich Merz became Germany’s new Chancellor, Pope Leo XIV was elected, and bond yields rose as markets reacted to fiscal concerns and central bank signals.

LCI Monthly - What Shaped April 2025

President Trump’s sweeping tariffs and public attacks on the Federal Reserve rattled markets and global allies in April 2025. His increasingly autocratic rhetoric added to geopolitical unease. Tesla reported a sharp earnings slump, hit by reputational backlash tied to Musk’s political ties. Meanwhile, U.S. consumer confidence dropped to a 13-year low, reflecting growing economic and political uncertainty.

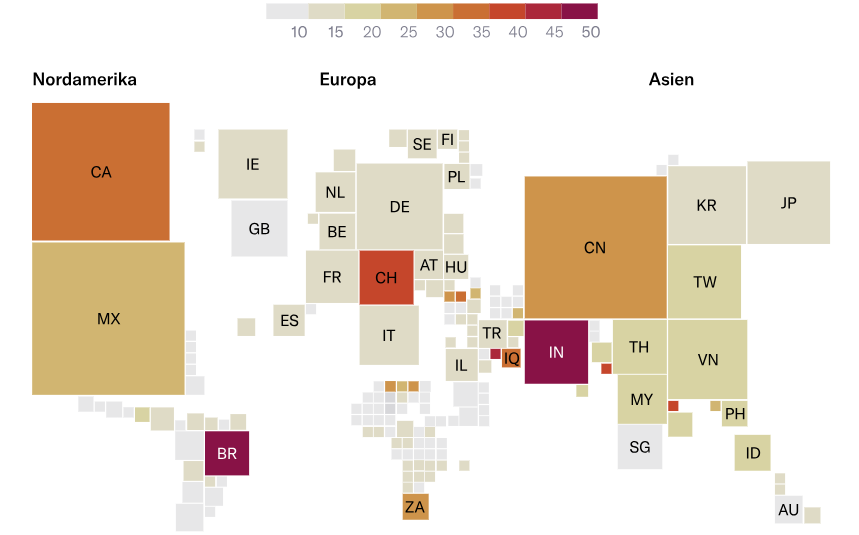

Prosperity Has a Foundation – and It's Beginning to Crumble

As democracy, rule of law, and open markets come under pressure—even in long-trusted economies like the U.S.—investors must rethink geographic diversification. Institutional resilience, not short-term data, is the true driver of sustainable returns. In a world of rising political risk, long-term capital should flow to countries where the foundational pillars of prosperity remain strong and intact.

OECD Economic Outlook – March 2025

Global growth held steady at 3.2% in 2024, but recent indicators show signs of weakening. Inflation remains persistent, sentiment is softening, and policy uncertainty is high. Risks include tighter monetary policy and financial market disruptions. A key concern is rising global fragmentation—though a reversal in tariffs could boost growth. The outlook is increasingly fragile and dependent on policy direction.

Trump est Néron pendant que Washington brûle

Le sénateur français Claude Malhuret lance un avertissement cinglant face au retrait de l’Amérique de son rôle de leader mondial, comparant Trump à Néron tandis que les piliers de la démocratie s’embrasent. Dans un discours devenu viral, il exhorte les Européens à se réveiller, à se réarmer moralement et militairement, et à défendre fermement l’Ukraine ainsi que les valeurs démocratiques. Selon lui, l’avenir de l’Europe dépend désormais de sa propre détermination — non de Washington.

US Stock Markets Under Pressure: Concerns Over Economic Slowdown Under Trump

Investor optimism following Trump’s re-election has faded amid rising fears of an economic slowdown. Markets tumbled, with the S&P 500 down 3% and Tesla plunging 15%. Slowing demand, political turmoil, and recession warnings weigh heavily. Bond yields have dropped, and key indicators point to weakening growth. Trump now frames the downturn as a “transition period”—but confidence is slipping fast.