LCI Monthly – What Shaped February 2026

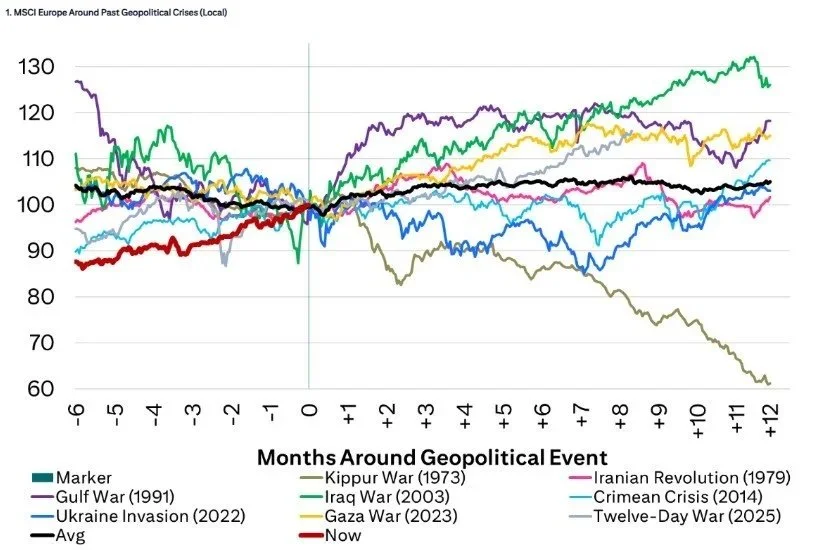

Artificial intelligence is disrupting the software industry, compressing margins and challenging traditional business models. At the same time, geopolitical tensions, currency shifts, trade disputes, and energy market shocks are reshaping the global economic landscape. Markets are navigating structural change across technology, geopolitics, trade policy, and global power balances.

LCI Monthly – What Shaped January 2026

Rising geopolitical tensions, trade realignments and institutional pressures marked the start of 2026. From U.S. intervention in Venezuela and renewed power politics to central bank independence concerns, landmark trade agreements and shifting investor sentiment, global politics and economics are increasingly shaped by coercion, strategic rivalry and fragile alliances.

LCI Monthly – What Shaped December 2025

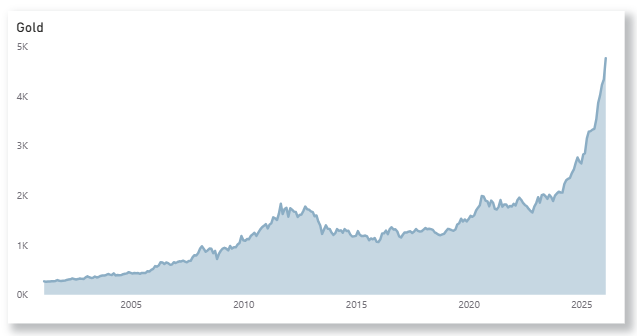

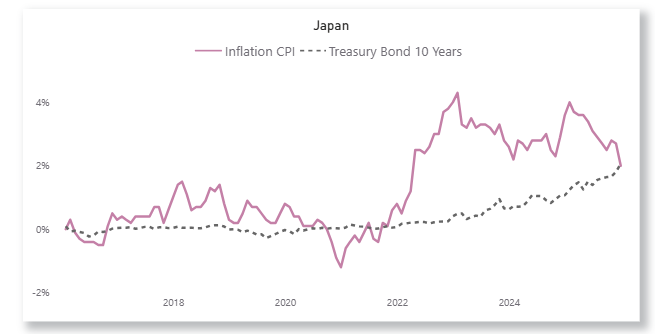

2025 was shaped by rising trade tensions, shifting geopolitics, AI adoption and resilient financial markets. Higher U.S. tariffs, China’s export dominance, changing security priorities, and the normalization of Japanese monetary policy all defined a complex global backdrop, while equity markets delivered strong but currency-dependent returns.

OECD Economic Outlook – December 2025

The OECD Economic Outlook highlights resilient global growth supported by improving financial conditions and AI investment, but warns of rising fragilities. Slowing labour markets, trade tensions, financial risks and weak productivity underline the need for structural reforms to secure sustainable growth and bring inflation back to target.

LCI Monthly – What Shaped November 2025

Global markets shift as major political and economic developments unfold: the U.S. ends its longest government shutdown, tariffs are rolled back, Switzerland strikes a landmark trade deal, Nvidia soars on explosive AI demand, China faces weakening growth, and expectations for a December Fed rate cut continue to build.

LCI Monthly – What Shaped October 2025

Global business activity strengthened in October as Germany and the U.S. led global growth momentum. Inflation rose to 3% in the U.S., while regional bank troubles resurfaced. China tightened rare earth exports, the U.S. sanctioned Russian oil giants, and Japan elected its first female prime minister amid shifting global dynamics.

The End of ESG

ESG is not dead—it’s evolving. Discover how Alex Edmans redefines environmental, social, and governance investing as an integral part of long-term value creation, beyond politics and box-ticking.

LCI Monthly – What Shaped September 2025

September 2025, a turbulent month in global politics and economics: Trump plans 100% tariffs on medicines and higher visa costs, while the Fed cuts rates under pressure. Europe faces U.S. demands on digital taxes, France loses its prime minister, and Russia strikes NATO territory. Gold hits record highs, Switzerland signs a Mercosur trade deal.

OECD Economic Outlook – September 2025

Global growth remained more resilient than expected in early 2025, driven by emerging markets and the US. Industrial activity and trade were boosted by front-loading ahead of US tariff hikes, which reached an effective rate of 19.5% by August — the highest since the 1930s. While the full impact is still unfolding, early signs of strain are visible in consumption, labour markets and prices. Risks to the outlook remain tilted to the downside, though easing trade restrictions or rapid advances in AI could provide upside surprises.

LCI Monthly – What Shaped August 2025

August 2025 saw mounting political pressure on the U.S. Fed and a looming confidence vote in France, shaking investor sentiment. While eurozone 10-year yields held steady, credit spreads in the U.S. remained tight amid demand for high-grade corporates. Global equities rose modestly, led by emerging Asian and resource-rich markets.

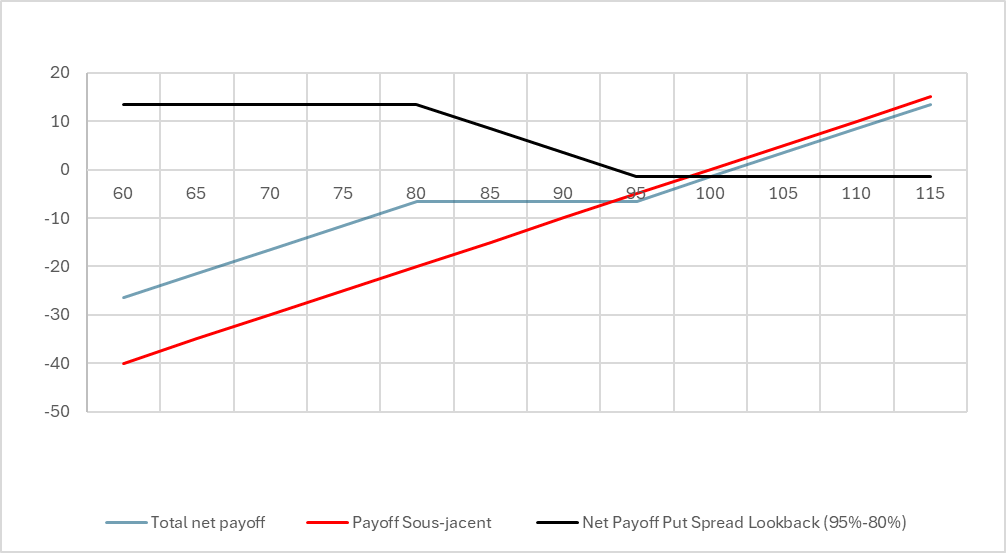

Too Many Challenges for Equity Markets: La Côte Invest Now Hedging 50% of Its Equity Exposure

Amidst global economic uncertainties, La Côte Invest is taking proactive measures by hedging 50% of its equity exposure. This strategic move involves implementing a Put Spread strategy with a lookback feature, aiming to protect the portfolio from potential market downturns.

LCI Monthly – What Shaped July 2025

U.S. inflation rose to 2.7% in July, keeping Fed rates steady at 4.25–4.50%. Trump escalated trade tensions with new tariffs, while markets rebounded, led by Nvidia surpassing $4 trillion. Spain faced tourism strikes, and England’s Lionesses clinched the UEFA Women’s Euro 2025 in Basel.

LCI Monthly – What Shaped June 2025

June was shaped by Middle East tensions, a sharp but short-lived oil price spike, and diverging central bank paths, with the Fed on hold and the ECB cutting rates. Trump’s renewed attacks on Powell pressured the dollar, while the BIS warned of rising global fragility. A 90-day US-China tariff truce brought only temporary relief to markets.

OECD Economic Outlook – June 2025

The global economic outlook is deteriorating, with rising trade barriers, policy uncertainty, and tightening financial conditions threatening growth. Inflation risks remain high, driven by trade disruptions—though lower commodity prices may offer some relief. A reversal in trade tensions could provide a much-needed boost.

LCI Monthly – What Shaped May 2025

May 2025 saw a shift in the global landscape: the U.S. economy contracted, Moody’s downgraded U.S. debt, and trade tensions eased with delayed tariffs. Equity markets rallied, especially in Europe and North America. Friedrich Merz became Germany’s new Chancellor, Pope Leo XIV was elected, and bond yields rose as markets reacted to fiscal concerns and central bank signals.

LCI Monthly - What Shaped April 2025

President Trump’s sweeping tariffs and public attacks on the Federal Reserve rattled markets and global allies in April 2025. His increasingly autocratic rhetoric added to geopolitical unease. Tesla reported a sharp earnings slump, hit by reputational backlash tied to Musk’s political ties. Meanwhile, U.S. consumer confidence dropped to a 13-year low, reflecting growing economic and political uncertainty.

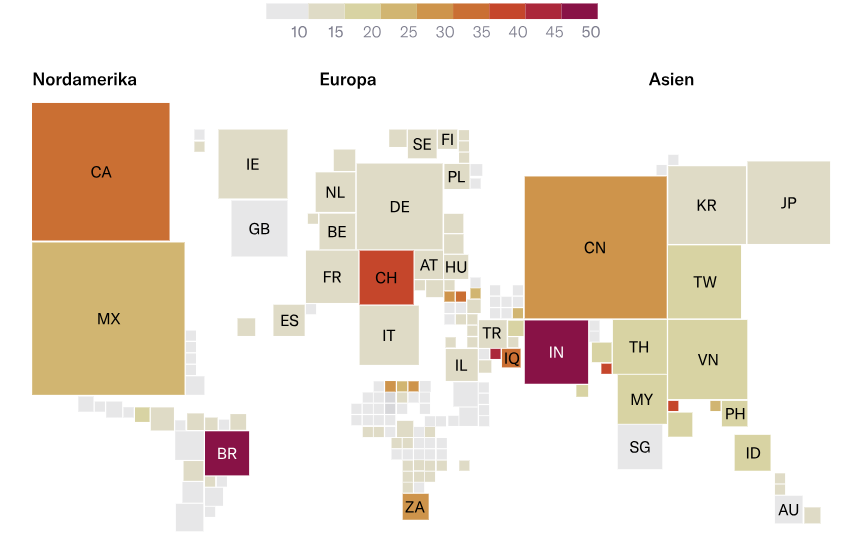

Prosperity Has a Foundation – and It's Beginning to Crumble

As democracy, rule of law, and open markets come under pressure—even in long-trusted economies like the U.S.—investors must rethink geographic diversification. Institutional resilience, not short-term data, is the true driver of sustainable returns. In a world of rising political risk, long-term capital should flow to countries where the foundational pillars of prosperity remain strong and intact.

OECD Economic Outlook – March 2025

Global growth held steady at 3.2% in 2024, but recent indicators show signs of weakening. Inflation remains persistent, sentiment is softening, and policy uncertainty is high. Risks include tighter monetary policy and financial market disruptions. A key concern is rising global fragmentation—though a reversal in tariffs could boost growth. The outlook is increasingly fragile and dependent on policy direction.

Trump Is Nero While Washington Burns

French Senator Claude Malhuret delivers a scathing warning about America’s retreat from global leadership, likening Trump to Nero as the pillars of democracy burn. His viral speech urges Europeans to wake up, rearm morally and militarily, and stand firm for Ukraine and democratic values. In his view, Europe's future now depends on its own resolve—not Washington’s.

US Stock Markets Under Pressure: Concerns Over Economic Slowdown Under Trump

Investor optimism following Trump’s re-election has faded amid rising fears of an economic slowdown. Markets tumbled, with the S&P 500 down 3% and Tesla plunging 15%. Slowing demand, political turmoil, and recession warnings weigh heavily. Bond yields have dropped, and key indicators point to weakening growth. Trump now frames the downturn as a “transition period”—but confidence is slipping fast.