LCI Monthly – Was den Februar 2026

Künstliche Intelligenz verändert die Softwarebranche grundlegend, setzt Margen unter Druck und stellt traditionelle Geschäftsmodelle infrage. Gleichzeitig prägen geopolitische Spannungen, Währungsverschiebungen, Handelskonflikte und Energieschocks die globale Wirtschaft neu. Die Märkte befinden sich in einem strukturellen Wandel bei Technologie, Handelspolitik und globalen Machtverhältnissen.

LCI Monthly – Was den Januar 2026 prägte

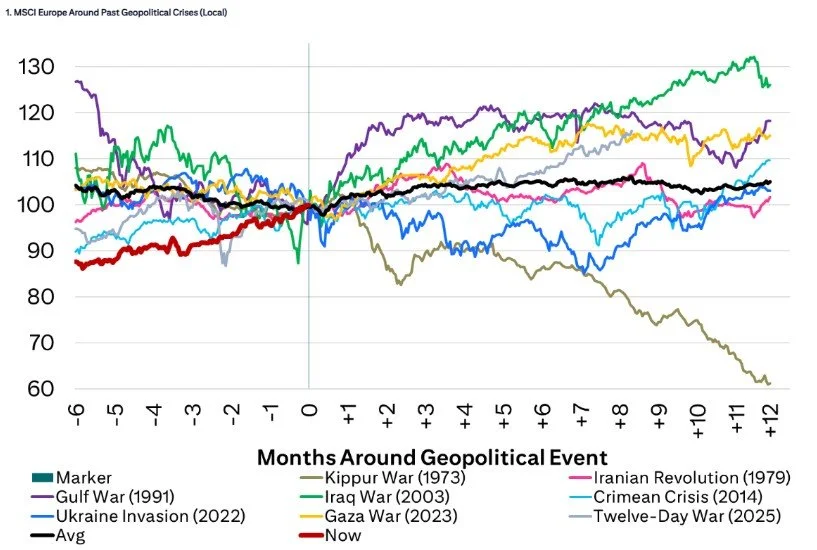

Der Beginn des Jahres 2026 ist geprägt von zunehmenden geopolitischen Spannungen, neuen Handelsallianzen und institutionellem Druck. Von der US-Intervention in Venezuela bis zu Angriffen auf die Unabhängigkeit von Zentralbanken zeigen sich globale Politik und Wirtschaft zunehmend von Machtpolitik, strategischer Rivalität und fragilen Bündnissen bestimmt.

LCI Monthly – Was den Dezember 2025 prägte

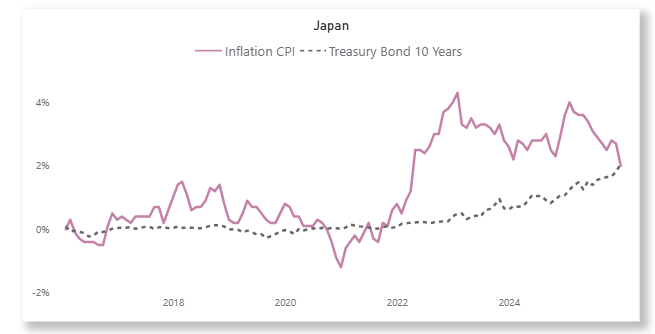

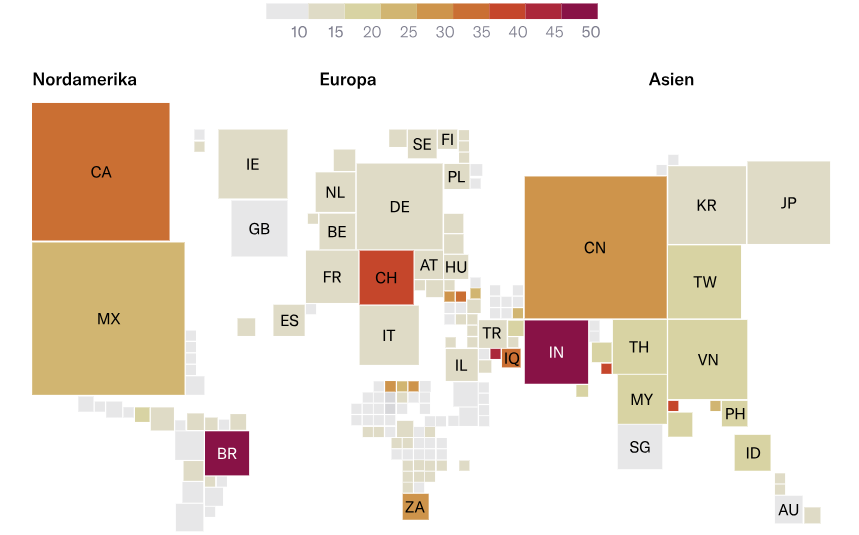

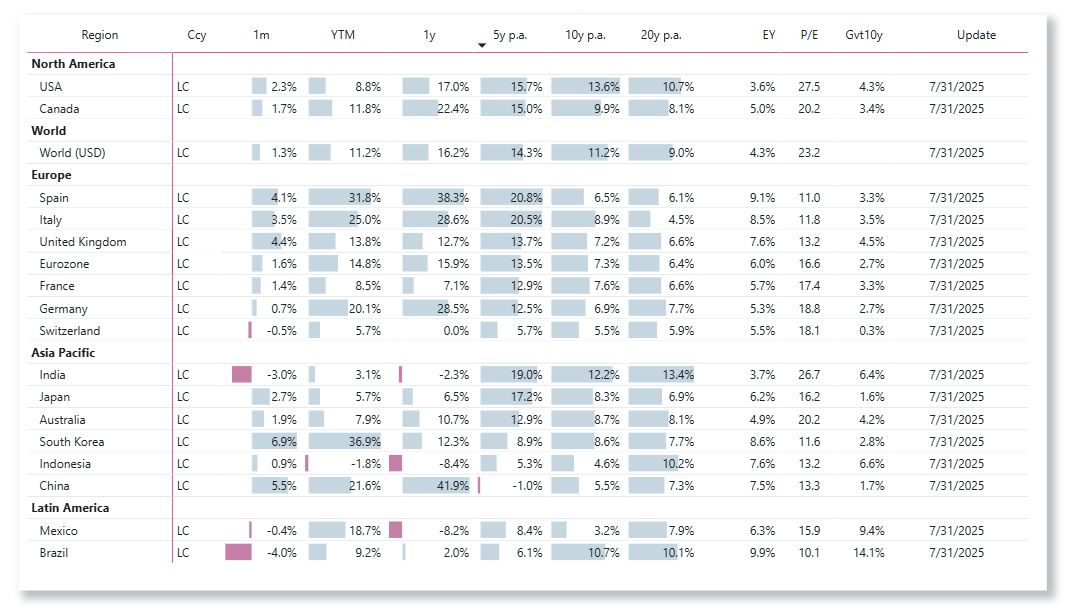

Das Jahr 2025 war geprägt von zunehmenden Handelskonflikten, geopolitischen Verschiebungen, der breiten Einführung von KI und widerstandsfähigen Finanzmärkten. Höhere US-Zölle, Chinas Exportdominanz, veränderte sicherheitspolitische Prioritäten sowie die Normalisierung der Geldpolitik in Japan bestimmten ein komplexes globales Umfeld, während die Aktienmärkte starke, jedoch währungsabhängige Renditen erzielten.

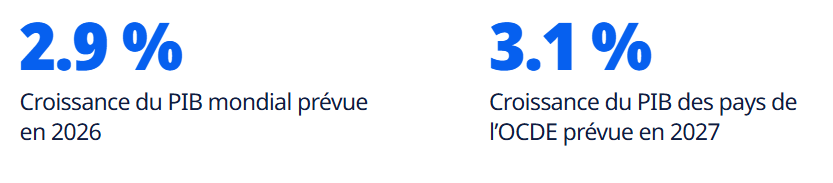

OECD-Wirtschaftsausblick – Dezember 2025

Der OECD-Wirtschaftsausblick vom Dezember 2025 zeigt eine robuste Weltwirtschaft mit zunehmenden Fragilitäten. Ein erwarteter Wachstumsrückgang, handelspolitische Spannungen und erste Schwächen am Arbeitsmarkt stellen relevante Risiken für Investoren dar. Die Inflation nähert sich den Zielwerten der Zentralbanken, während strukturelle Reformen entscheidend bleiben, um das langfristige Wachstum zu stärken.

LCI Monthly – Was den November 2025 prägte

Die Weltmärkte reagieren auf bedeutende politische und wirtschaftliche Entwicklungen: Die USA beenden den längsten Government Shutdown ihrer Geschichte, Zölle werden gesenkt, die Schweiz erzielt ein wichtiges Handelsabkommen, Nvidia steigt dank KI-Boom stark, Chinas Wachstum schwächt sich ab und Erwartungen für einen Zinsschnitt im Dezember nehmen zu.

LCI Monthly – Was den Oktober 2025 prägte

Die weltweite Wirtschaftstätigkeit hat sich im Oktober verstärkt, wobei Deutschland und die USA das globale Wachstum anführten. Die Inflation stieg in den USA auf 3 %, während Probleme regionaler Banken erneut auftraten. China verschärfte seine Ausfuhrbeschränkungen für seltene Erden, die USA sanktionierten russische Ölkonzerne, und Japan wählte seine erste Premierministerin – ein Zeichen des globalen Wandels.

Das Ende von ESG

ESG ist nicht tot – es entwickelt sich weiter. Erfahren Sie, wie Alex Edmans Umwelt-, Sozial- und Governance-Investitionen als integralen Bestandteil langfristiger Wertschöpfung neu definiert.

LCI Monthly – Was den September 2025 prägte

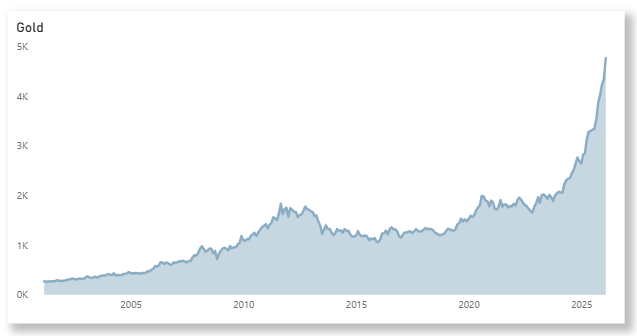

September 2025, ein turbulenter Monat in Politik und Wirtschaft: Trump plant 100 %-Zölle auf Medikamente und höhere Visagebühren, während die Fed die Zinsen senkt. Frankreich verliert seinen Premier, Russland greift Nato-Gebiet an, die Schweiz unterzeichnet ein Mercosur-Abkommen, und Gold erreicht ein Rekordhoch.

OECD-Wirtschaftsausblick – September 2025

Die Weltwirtschaft erwies sich im ersten Halbjahr 2025 als widerstandsfähiger als erwartet, getragen von Schwellenländern und den USA. Doch höhere Zölle, anhaltende Dienstleistungsinflation und fiskalische Risiken belasten die Aussichten. Eine Lockerung der Handelsbeschränkungen oder Fortschritte bei der KI könnten hingegen neue Impulse für das Wachstum liefern.

LCI Monthly – Was den August 2025 prägte

Im August 2025 stieg der politische Druck auf die US-Notenbank, und ein bevorstehendes Misstrauensvotum in Frankreich erschütterte die Stimmung der Anleger. Während die Renditen 10-jähriger Staatsanleihen im Euroraum stabil blieben, blieben die Kreditspreads in den USA eng, gestützt durch die Nachfrage nach hochwertigen Unternehmensanleihen. Die globalen Aktienmärkte legten leicht zu, angeführt von aufstrebenden asiatischen Märkten und rohstoffreichen Volkswirtschaften.

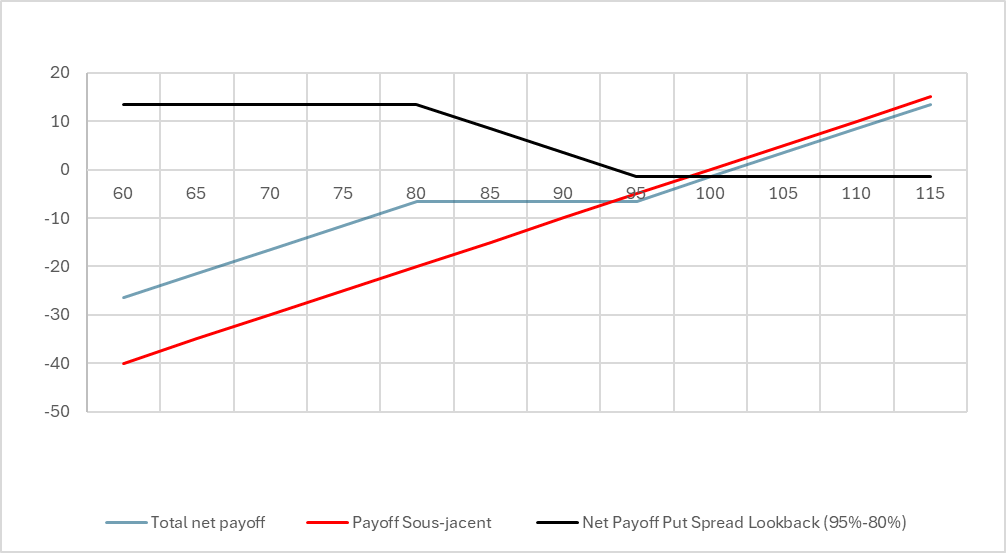

Zu viele Herausforderungen für die Aktienmärkte: La Côte Invest deckt nun 50 % seiner Aktienposition ab

Angesichts globaler wirtschaftlicher Unsicherheiten trifft La Côte Invest proaktive Maßnahmen und deckt 50 % seiner Aktienposition ab. Diese strategische Entscheidung beinhaltet die Implementierung einer Put-Spread-Strategie mit einer Rückblick-Funktion, um das Portfolio vor möglichen Marktrückgängen zu schützen.

LCI Monthly – What Shaped July 2025

U.S. inflation rose to 2.7% in July, keeping Fed rates steady at 4.25–4.50%. Trump escalated trade tensions with new tariffs, while markets rebounded, led by Nvidia surpassing $4 trillion. Spain faced tourism strikes, and England’s Lionesses clinched the UEFA Women’s Euro 2025 in Basel.

LCI Monthly – What Shaped June 2025

June was shaped by Middle East tensions, a sharp but short-lived oil price spike, and diverging central bank paths, with the Fed on hold and the ECB cutting rates. Trump’s renewed attacks on Powell pressured the dollar, while the BIS warned of rising global fragility. A 90-day US-China tariff truce brought only temporary relief to markets.

OECD Economic Outlook – June 2025

The global economic outlook is deteriorating, with rising trade barriers, policy uncertainty, and tightening financial conditions threatening growth. Inflation risks remain high, driven by trade disruptions—though lower commodity prices may offer some relief. A reversal in trade tensions could provide a much-needed boost.

LCI Monthly – What Shaped May 2025

May 2025 saw a shift in the global landscape: the U.S. economy contracted, Moody’s downgraded U.S. debt, and trade tensions eased with delayed tariffs. Equity markets rallied, especially in Europe and North America. Friedrich Merz became Germany’s new Chancellor, Pope Leo XIV was elected, and bond yields rose as markets reacted to fiscal concerns and central bank signals.

LCI Monthly - What Shaped April 2025

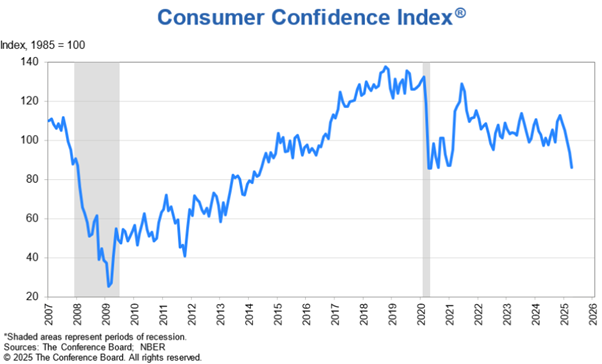

President Trump’s sweeping tariffs and public attacks on the Federal Reserve rattled markets and global allies in April 2025. His increasingly autocratic rhetoric added to geopolitical unease. Tesla reported a sharp earnings slump, hit by reputational backlash tied to Musk’s political ties. Meanwhile, U.S. consumer confidence dropped to a 13-year low, reflecting growing economic and political uncertainty.

Prosperity Has a Foundation – and It's Beginning to Crumble

As democracy, rule of law, and open markets come under pressure—even in long-trusted economies like the U.S.—investors must rethink geographic diversification. Institutional resilience, not short-term data, is the true driver of sustainable returns. In a world of rising political risk, long-term capital should flow to countries where the foundational pillars of prosperity remain strong and intact.

OECD Economic Outlook – March 2025

Global growth held steady at 3.2% in 2024, but recent indicators show signs of weakening. Inflation remains persistent, sentiment is softening, and policy uncertainty is high. Risks include tighter monetary policy and financial market disruptions. A key concern is rising global fragmentation—though a reversal in tariffs could boost growth. The outlook is increasingly fragile and dependent on policy direction.

Trump ist Nero, während Washington brennt

Der französische Senator Claude Malhuret warnt eindringlich vor dem Rückzug der USA von der Weltbühne. Er vergleicht Trump mit Nero, während die Pfeiler der Demokratie brennen, und ruft die Europäer auf, moralisch und militärisch aufzurüsten, die Ukraine zu unterstützen und die demokratischen Werte zu verteidigen.

US Stock Markets Under Pressure: Concerns Over Economic Slowdown Under Trump

Investor optimism following Trump’s re-election has faded amid rising fears of an economic slowdown. Markets tumbled, with the S&P 500 down 3% and Tesla plunging 15%. Slowing demand, political turmoil, and recession warnings weigh heavily. Bond yields have dropped, and key indicators point to weakening growth. Trump now frames the downturn as a “transition period”—but confidence is slipping fast.