Analyse financière

Facteurs clés de notre stratégie d’investissement

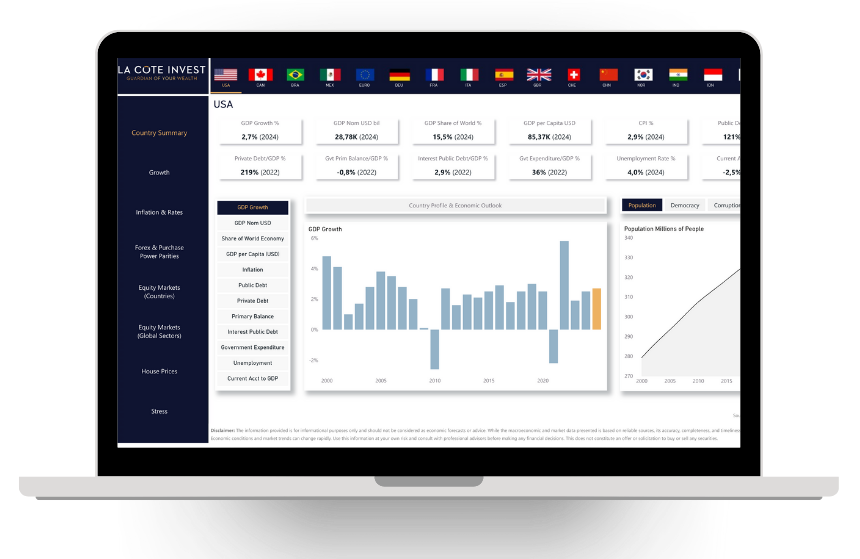

Cette page présente les principaux indicateurs qui guident actuellement les décisions d’investissement de LCI. Vous y trouverez :

-

Les fondamentaux économiques de chaque pays, accompagnés d’un profil, d’une carte et des perspectives économiques de l’OCDE. Nous suivons également les facteurs politiques et de gouvernance tels que la démocratie, la corruption et la compétitivité. Ces données sont mises à jour une fois par an.

-

Principaux indicateurs de croissance, notamment la croissance du PIB, le chômage, la productivité, ainsi que des indicateurs avancés tels que les PMI.

-

Indices des prix à la consommation (IPC), taux d’intérêt à court et long terme. À partir de ces données, nous calculons les taux d’intérêt réels (taux nominaux moins inflation) et la courbe des taux (écart entre les obligations d’État à 10 ans et à 1 an), ce qui permet d’évaluer la position d’une économie dans le cycle conjoncturel.

-

Nous comparons les taux de change actuels aux valeurs de long terme de la PPA. La PPA suppose qu’à long terme, des biens identiques devraient coûter le même prix dans différents pays, une fois les taux de change ajustés.

Exemple : Si un Big Mac coûte 5 $ aux États-Unis et 6 CHF en Suisse, le taux de change PPA devrait être de 1.20 CHF/USD. Si le taux réel est de 1.00, le franc suisse pourrait être surévalué. -

Performance par pays et par secteur, croissance des bénéfices, rendement des bénéfices, ratios cours/bénéfices (P/E) et prime de risque actions.

-

Prix des logements nominaux et corrigés de l’inflation dans différents pays.

-

Mesures du stress financier, y compris les indices de volatilité, les spreads de crédit et le prix de l’or.