LCI Monthly – What Shaped January 2026

Economy & Politics

United States Announces Temporary Administration of Venezuela Following Capture of President Maduro

On 3 January 2026, the United States announced that it had placed Venezuela under temporary U.S. administration following a covert operation that led to the capture of President Nicolás Maduro. According to U.S. authorities, Maduro was transferred to New York to stand trial on charges related to drug trafficking. In a public statement, President Donald Trump said that the United States would govern the country on an interim basis “until a safe, proper and judicious transition” to a new political order could be implemented. He did not provide detailed information on the legal or administrative framework of the interim governance. President Trump also stated that, as part of the transition process, major U.S. oil companies would be involved in restoring and operating Venezuela’s energy sector, with the stated objective of stabilising the economy and securing critical infrastructure.

The U.S. Attack on Venezuela and the Return of Power Politics

The U.S. attack on Venezuela and the capture of President Nicolás Maduro signal a broader shift in global affairs: the return of imperial power politics. The United States, once the central guarantor of the post-war rules-based international order, now appears willing to act openly according to the logic of strength rather than law. There is little effort to justify such actions through values or multilateral frameworks; the assertion of national interest alone seems sufficient. This development reflects a wider global reality in which major power blocs operate with increasing freedom within their spheres of influence. The United States dominates the Americas, Russia asserts itself in Eastern Europe, and China expands its reach in the South China Sea. Rules, treaties, and long-standing alliances are losing their restraining power.

The implications for U.S. allies are profound. Greenland has emerged as a potential flashpoint, alarming Denmark to the point that its intelligence services now, for the first time, include the United States in their threat assessments. An American move against Greenland would place Europe and NATO in an impossible position. Such an action would effectively undermine the alliance itself and mark the end of the security framework that has underpinned Europe since the Second World War.

Trump Escalates War on the Fed, Threatening Powell and Central Bank Independence

Donald Trump has sharply escalated his clash with Federal Reserve Chair Jerome Powell, openly threatening him with criminal prosecution in what critics see as a direct attack on the independence of the U.S. central bank. Using cost overruns in a $2.5 billion renovation of the Fed’s Washington headquarters as a pretext, the Justice Department has accused Powell of misleading Congress. After months of absorbing pressure in silence, Powell has responded unusually forcefully, denouncing the investigation as a politically motivated attempt to intimidate the Fed into cutting interest rates. He warned that the real issue at stake is whether monetary policy will continue to be guided by economic realities—or instead by presidential pressure and coercion.

Canada and China Strike Initial Trade Deal, Slashing EV and Canola Tariffs

Canada and China have reached an initial trade deal aimed at easing recent trade tensions and rebuilding bilateral ties during Prime Minister Mark Carney’s visit to Beijing. The agreement significantly reduces Canadian tariffs on Chinese electric vehicles, replacing the previous 100% duty with a quota-based system starting at 6.1%, while China will sharply lower tariffs on Canadian canola and remove discriminatory duties on several agricultural and seafood products. The deal is expected to unlock nearly $3 billion in Canadian exports and revive trade after a sharp decline in 2025. Both countries also agreed to restart high-level economic dialogue, expand cooperation in energy and green technologies, and improve travel access, although the move has drawn criticism from some Canadian and U.S. officials for diverging from U.S. trade policy.

EU and Mercosur Sign Landmark Trade Deal After 25 Years of Negotiations

After 25 years of negotiations, the European Union and the South American bloc Mercosur have signed a trade agreement aimed at reducing tariffs and boosting bilateral trade. The deal now requires approval by the European Parliament and ratification by the parliaments of Mercosur member states Argentina, Brazil, Paraguay and Uruguay. Trade between the two blocs, representing a combined market of 700 million people, reached €111 billion in 2024. EU exports mainly consist of machinery, chemicals and transport equipment, while Mercosur exports are largely agricultural products, minerals, pulp and paper.

Trump Steps Up Pressure on Europe Over Greenland

What began in 2019 as an apparently outlandish idea has evolved into a blunt exercise in power politics. Donald Trump’s ambition to bring Greenland under U.S. control, once brushed off as a provocation, is now being pursued with open coercion. Since returning to office, Trump has repeatedly insisted that the issue is “very serious,” tying it to recent U.S. military actions abroad and framing territorial acquisition as a strategic necessity. In early January, his administration crossed another line by openly suggesting that military force could not be ruled out. Most recently, Trump has escalated further, threatening European countries with punitive tariffs if they refuse to comply with Washington’s demands. The message to Europe is unmistakable: strategic interests will be enforced not through diplomacy, but through pressure, intimidation and economic leverage.

Europe’s Pension Funds Trim U.S. Treasury Exposure Amid Growing Concerns

Europe’s largest pension fund cut its exposure to U.S. Treasuries in 2025, reducing holdings by about €10 billion to €19 billion in the six months to September. Similar moves by Danish and Swedish funds reflect concerns over U.S. fiscal discipline, a weakening dollar and geopolitical tensions. While modest relative to the size of the Treasury market, these sales suggest some institutional investors are reassessing their reliance on U.S. assets.

EU Extends Suspension of Retaliatory Tariffs on U.S. Goods

The EU will extend for six months the suspension of retaliatory tariffs on €93 billion of U.S. goods after President Trump withdrew a threat to impose new levies on certain EU countries amid tensions over Greenland. The European Commission plans to formalize the extension before the Feb. 7 expiry, while keeping the option to quickly reactivate the countermeasures if needed.

India and EU Seal Landmark Free Trade Agreement After Two Decades of Talks

India and the EU have finalised a long-awaited free trade agreement after nearly two decades of negotiations, aiming to deepen economic ties and reduce reliance on the U.S. The deal will open India’s vast market to the EU, its largest trading partner, with bilateral trade already at $136.5bn. Leaders are set to announce details at an India–EU summit in New Delhi. After legal vetting, the agreement is expected to enter into force within about a year.

Indonesia’s Investor Confidence Shaken as Governance and Fiscal Risks Rise

Indonesia’s investment outlook has deteriorated sharply under President Prabowo Subianto, who took office in October 2024 with ambitious growth plans. Investor confidence has weakened amid a stock market slump, a currency near record lows, and heavy foreign selling of bonds, driven by fiscal concerns and governance risks. MSCI has warned of transparency issues and a potential downgrade of Indonesia’s market status from emerging to frontier. While some problems predate Prabowo, recent actions — including the removal of a respected finance minister, increased state intervention in key industries, and concerns over central bank independence — have heightened fears over policy direction and institutional stability.

Trump nominates Kevin Warsh to lead the Fed

President Donald Trump has nominated Kevin Warsh to chair the Federal Reserve. Despite Trump’s calls for aggressive rate cuts, markets expect only limited easing, and Warsh—an inflation hawk—is unlikely to push rates to crisis levels. Warsh has criticized the Fed’s expanded role since the financial crisis and may seek tighter messaging, a narrower mandate, and a rethink of its relationship with the Treasury under Scott Bessent. However, major reforms would require congressional approval, limiting how fast and how far change can go.

Gold

Markets

Global Overview

Global equities got off to a strong start to the year, rising 2.3% in USD terms and 1.3% in EUR, while posting a modest decline of 0.2% in CHF. The U.S. Dollar Index weakened by 1.1% over the month. Fixed income markets were broadly stable across the spectrum. Gold rallied sharply, reaching record highs above USD 5,000 per ounce, supported by strong safe-haven demand amid heightened macroeconomic uncertainty, despite bouts of volatility and profit-taking toward month-end.

Europe

European markets began 2026 strongly, rising 3.2%, and gains broadly shared across large, mid, and small caps. Information Technology led after a weak 2025, surging 11% on strong semiconductor performance, while Utilities also performed well. In contrast, Consumer Discretionary lagged sharply, falling 8%.

Bond markets posted modest gains across both corporate and sovereign segments, with inflation-linked bonds outperforming. Market volatility increased, with the VSTOXX ending January at 20, its highest month-end level since April. Commodities had a standout month, rising 12%, driven mainly by higher precious metal prices.

North America

U.S. equities had a volatile start to the year. Early turbulence—driven by a sell-off in Japanese government bonds and tariff concerns—triggered the worst one-day drop since October 2025 and pushed volatility above 20. Despite this, markets recovered, reaching new all-time highs and ending the month up 1.3%, even after a late pullback linked to weak Big Tech earnings, inflation worries, and uncertainty around the next Fed chair. The rally broadened beyond large caps, supported by solid economic data and earnings: mid- and small-cap stocks gained 4% and 6%, respectively. Sector performance was mostly positive, led by strong rotations into Energy (+14%) and Materials (+9%).

Fixed income markets also delivered positive returns across the credit spectrum.

Latin America

Latin American equities delivered a strong performance in January, supported by improving investor sentiment and attractive valuations. Brazil led the region with a sharp gain of 12.1%, driven by domestic equities, while Mexico also advanced solidly, up 5.8%. Overall, the region outperformed most developed markets at the start of the year.

Asia-Pacific

Asia-Pacific equities began the year on a strong footing, gaining 7% in January. South Korea led the region with a surge of 28%, followed by Taiwan and Hong Kong, each up 11%. In contrast, Indonesia declined by 4.1% after MSCI warned of a potential downgrade due to free-float concerns. Indian equities also underperformed, falling 2.9%. Chinese equities delivered solid gains, rising 4.1%. Japanese equities extended their upward momentum, advancing 4.9% in January and marking their 11th consecutive monthly gain. Japanese government bonds remained under pressure, with the iBoxx Global Government Japan index down 1%, as fiscal risk concerns intensified following Prime Minister Takaichi’s proposals for tax cuts and increased government spending. As long-dated Japanese government bond yields climbed to multi-decade highs, the Japanese yen reversed its earlier weakness against the U.S. dollar. Australian equities also started the year positively, rising 1.5% in January.

Learn more on LCI Research

Equity Performance of selected Countries

Equity Markets in Local Currency

Equity Performance of Global Sectors

Equity Global Sectors in USD

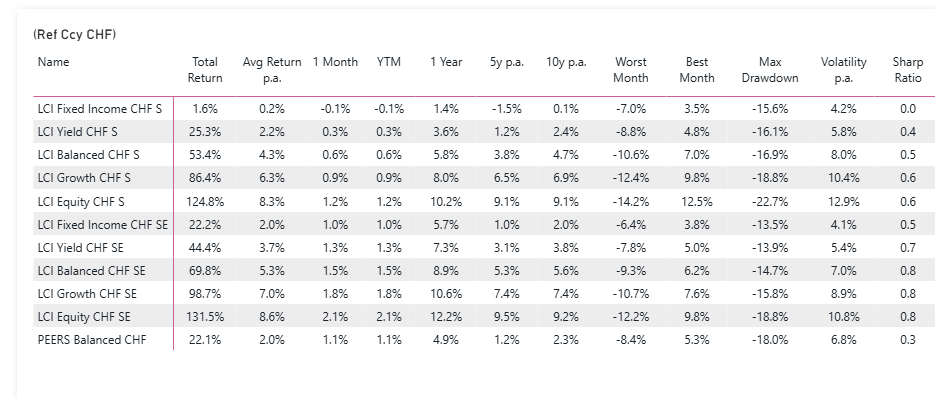

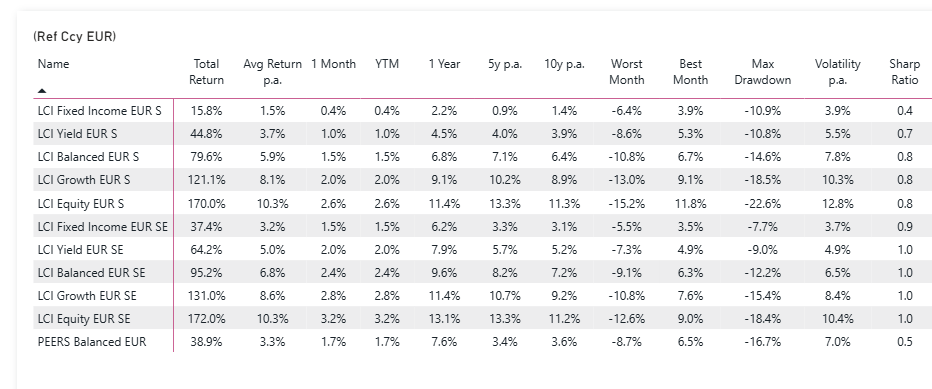

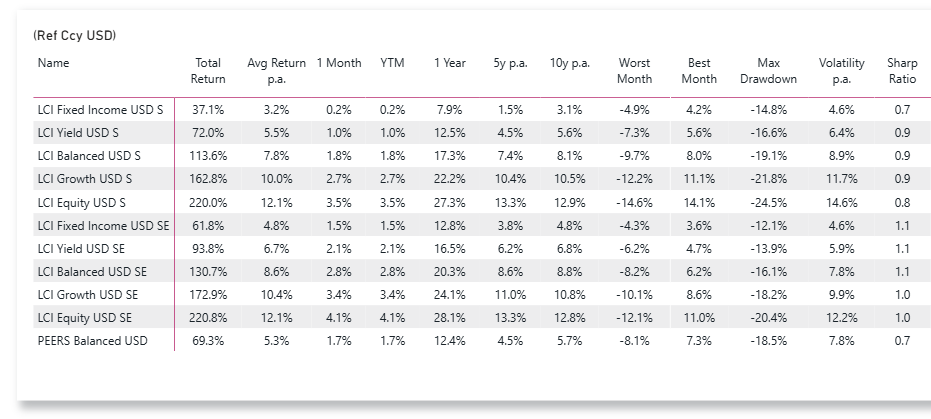

Learn more about LCI Strategies

LCI Strategies Performance update

LCI Strategies in CHF, EUR and USD