LCI Monthly – What Shaped December 2025

Economy & Politics

Global Economy Adjusts to Higher U.S. Tariffs Amid Trade Frictions and Policy Shifts

In 2025 the global economy was adjusting to the largest increase in U.S. tariffs in decades. Despite fears of severe economic fallout, the impact on the U.S. economy has so far been muted, though there are few signs of a meaningful revival. The Yale Budget Lab estimates the average U.S. effective tariff rate at 16.8% as of mid-November, the highest level since 1935. Inflation concerns linked to these tariffs have already influenced monetary policy, with some Federal Reserve members opposing a further rate cut and expectations growing that the Fed will proceed cautiously as price pressures persist.

Meanwhile, the U.S. labor market remains fragile, highlighting a growing economic divide between higher-income households driving consumption and a broader population facing more limited gains—an imbalance likely to remain prominent in 2026.

Internationally, India’s exports to the U.S. have stayed resilient despite higher tariffs, strengthening its negotiating position in ongoing trade discussions. China has also broadly met its commitments in trade talks. In contrast, relations with the U.K. and the European Union have become more strained. The U.S. has paused a major technology deal with the U.K. and is increasingly critical of Europe’s regulatory stance toward Big Tech, threatening retaliatory measures. At the same time, the EU faces setbacks in its green transition, scaling back its 2035 combustion-engine ban as automakers retreat from ambitious electric-vehicle plans.

China Surges Past $1 Trillion Trade Surplus, Defying Tariffs and Dominating Global Markets

China’s export industry continues to expand despite U.S. tariffs imposed under President Trump. In November, China posted unexpectedly strong export figures, pushing its annual trade surplus above one trillion dollars for the first time. Compared with last year, the surplus jumped 21% to USD 1.076 trillion, and is 44% higher than in 2023. Exports are rising rapidly while imports remain almost flat. This shift is visible globally: sales to Europe and Asia increased strongly, including gains of more than 20% to Thailand and Vietnam, and nearly 12% to India. Switzerland also reflects this trend, as Chinese exports rose by 6.3% while imports of Swiss goods fell by 7%.

The export boom is helping China approach its economic growth target of 5% despite weak domestic demand, which continues to be held back by a prolonged property crisis. Although the government regularly promises to strengthen household consumption, China remains heavily dependent on export-driven industrial investment. State-supported sectors often produce excess supply and sell abroad at low prices, dominating markets such as solar equipment (90% share) and increasingly electric vehicles, where exports are expected to reach 6.5 million units this year.

Meanwhile, Western countries remain highly dependent on Chinese raw materials such as rare earth elements and increasingly on Chinese technology, including artificial-intelligence chips. Analysts therefore warn that China is emerging as the main winner of the global trade conflict.

U.S. Pressure on Venezuela: Military Posturing Masking Strategic Oil and Resource Interests

The United States is intensifying its military pressure on Venezuela under President Trump, officially citing a fight against drug trafficking. However, experts widely agree that economic and geopolitical motives lie behind Washington’s actions. Venezuela possesses the world’s largest proven oil reserves and significant deposits of gold, diamonds, uranium, coltan, and rare earths—resources currently exploited by China, Russia, Iran and criminal groups. Control over these assets would strengthen U.S. energy security, reduce dependence on rival powers, and reinforce the U.S. view of Latin America as its primary sphere of influence.

A military buildup in the Caribbean signals Washington’s leverage: a U.S. aircraft carrier strike group, fighter jets in Puerto Rico, radar systems in Tobago, and 15,000 U.S. troops positioned nearby. Although negotiations with President Nicolás Maduro have occurred, including his reported offer to open Venezuela’s resource industries predominantly to U.S. firms, Washington has not accepted the terms, possibly to force deeper concessions.

American companies such as Chevron already operate in Venezuela and are poised to expand if sanctions and political barriers are lifted. Venezuelan oil is especially valuable to U.S. Gulf Coast refineries, which were designed for its heavy crude. Beyond oil, Venezuela’s minerals attract global investors, while sanctioned states use its resources to bypass financial restrictions, often through cryptocurrency networks.

A democratic transition could open vast business opportunities—estimated at up to $1.7 trillion over 15 years—making Venezuela one of the most strategically coveted economies in the world.

U.S. Security Strategy Shifts Under Trump: Europe Reduced to a Secondary, Problematic Partner

The United States has released a new National Security Strategy under President Donald Trump, revealing a dramatic shift in global priorities. Unlike previous administrations, the report does not portray Russia as the main threat. Instead, it frames European migration policies as a destabilizing force, warning that demographic changes could make some NATO countries “no longer European,” undermining shared identity. The strategy suggests that transatlantic ties rest less on common democratic values than on cultural and ethnic similarities.

Washington accuses European governments of suppressing public desire for peace in Ukraine, claiming they limit free speech to maintain support for the war. Despite labeling Europe strategically important, the document ranks other regions above it: Latin America—where the U.S. seeks to reassert dominance under a revived Monroe Doctrine—and Asia are prioritized first.

Trump’s strategy envisions a Europe composed of “sovereign nations” rather than an integrated EU. The U.S. intends to support “patriotic” nationalist governments, particularly in Central, Eastern, and Southern Europe, through trade, arms, and political cooperation. This approach promotes forces often aligned with Russia while simultaneously demanding that Europe rapidly assume full responsibility for its own defense by 2027. NATO expansion is ruled out, effectively closing the door on Ukraine’s future membership.

The contrast with President Biden’s strategy is stark. While Biden emphasized defending democracy against authoritarian rivals, Trump’s document downplays ideological struggle and instead elevates migration as a top security threat, valuing alliances primarily through economic and strategic interests rather than shared democratic principles.

Japan Turns the Page on Decades of Ultra-Low Interest Rates

After roughly three decades of ultra-low rates, the Bank of Japan has lifted its policy rate to 0.75%, a move that had been clearly signalled in advance. Despite the hike, the central bank stressed that monetary conditions remain very accommodative, with real interest rates still deeply negative. It also reaffirmed its readiness to tighten further if growth and inflation evolve as expected.

Officials expressed growing confidence that sustained wage increases will help keep inflation close to the 2% target—an outcome the BOJ has long sought. Financial markets reacted accordingly, with long-term government bond yields rising to levels not seen since the late 1990s, reflecting expectations of a gradual but ongoing normalization of Japanese monetary policy.

U.S. Pressure on Venezuela Raises Wider Geopolitical Risks

Donald Trump’s move to block sanctioned oil tankers from entering or leaving Venezuela represents a sharp intensification of U.S. efforts to weaken President Nicolás Maduro by targeting the country’s main revenue source. However, the decision has sparked legal and strategic concerns, including questions over whether such a blockade could be viewed as an act of war under international norms.

Beyond Latin America, the move carries broader implications for global security. Analysts warn it could weaken the U.S. position in opposing potential coercive actions by China against Taiwan. By setting a precedent for using blockades to influence political outcomes, Washington may inadvertently provide Beijing with an argument to justify similar pressure in the Taiwan Strait, complicating efforts to rally international support against such actions.

EU Agrees on Borrowing Plan to Sustain Ukraine’s Defence

European Union leaders have agreed to raise funds collectively in order to provide around €90 billion in loans to Ukraine to support its defence over the next two years. This approach avoids directly using frozen Russian state assets, a proposal that had caused legal and political disagreements among member states, particularly in countries where most of those assets are held.

While the European Commission was asked to continue exploring ways to link future financing to immobilised Russian assets, that option was deemed impractical for now. The borrowing plan moved forward after several initially reluctant countries agreed, provided they would not bear additional financial costs. EU leaders reaffirmed that Russian assets in Europe will stay frozen and could eventually be used if Russia pays war reparations, potentially allowing Ukraine to repay the loans in the future.

AI in 2025: From Niche Technology to Everyday Companion

By 2025, artificial intelligence has become an integral part of daily life rather than a distant technological promise. AI-powered chat tools now assist millions of people with writing, research, customer service, and personal productivity, blurring the line between human and machine collaboration. In music, AI is widely used for composition, sound design, mixing, and live performance support, empowering both professionals and hobbyists to explore new creative possibilities. Programmers rely on AI copilots to write, debug, and optimize code, significantly accelerating development cycles and lowering entry barriers.

This rapid adoption is matched by unprecedented financial commitment. Hundreds of billions of US dollars are flowing into AI-related investments, spanning data centers, semiconductors, cloud infrastructure, and software platforms. Major technology companies, venture capital funds, and governments view AI as critical infrastructure for future competitiveness. In 2025, AI is no longer just a tool for specialists—it is a foundational layer shaping how people work, create, and invest.

BYD Overtakes Tesla as Global EV Leader

Tesla has lost its position as the world’s largest electric-vehicle manufacturer, falling behind China’s BYD after a second consecutive year of declining sales. While global EV demand expanded strongly—up roughly 28% last year—Tesla’s deliveries dropped by about 8.6%, pressured by intensifying competition, the end of U.S. tax incentives, and growing brand-related headwinds.

BYD surpassed Tesla in annual sales for the first time, supported by rapid expansion in Europe, where the Chinese automaker continues to strengthen its lead. Tesla now faces mounting challenges in its core automotive business, particularly in Europe, as CEO Elon Musk increasingly shifts strategic focus toward future technologies such as robotaxis and humanoid robotics.

Japan inflation and interest rates

Markets

Global Overview

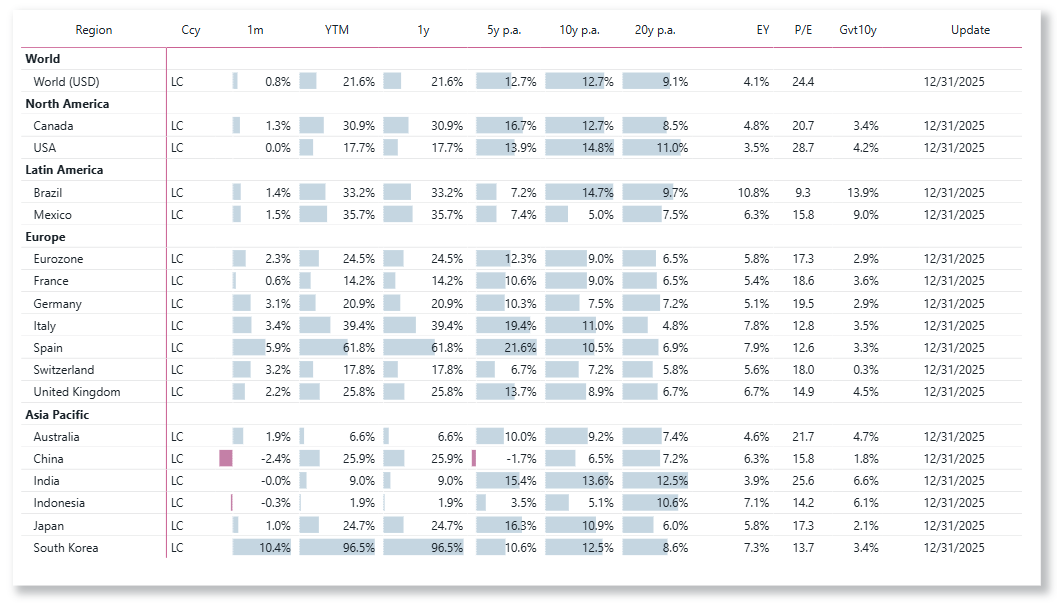

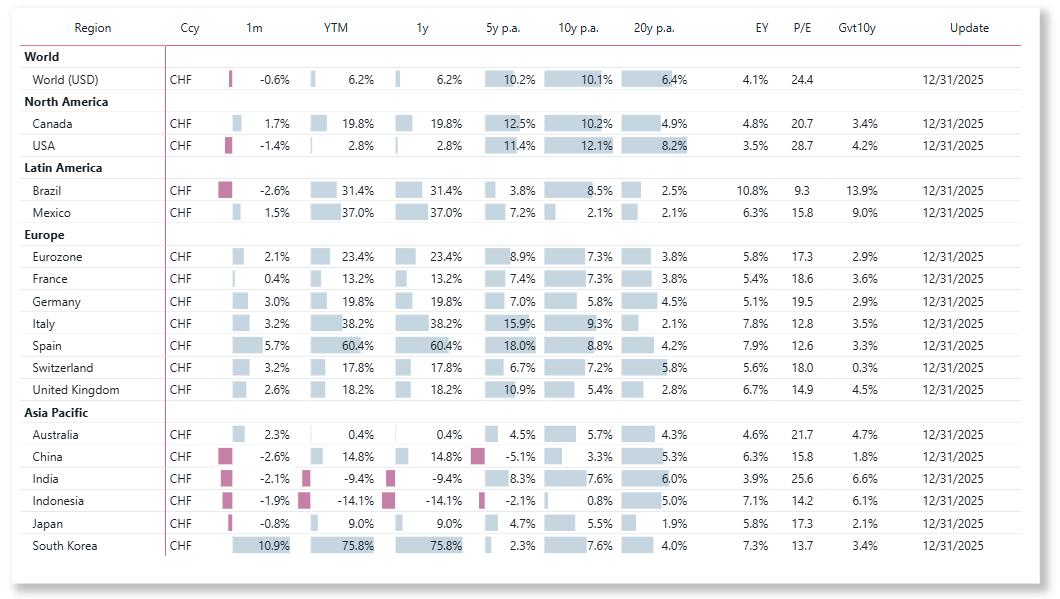

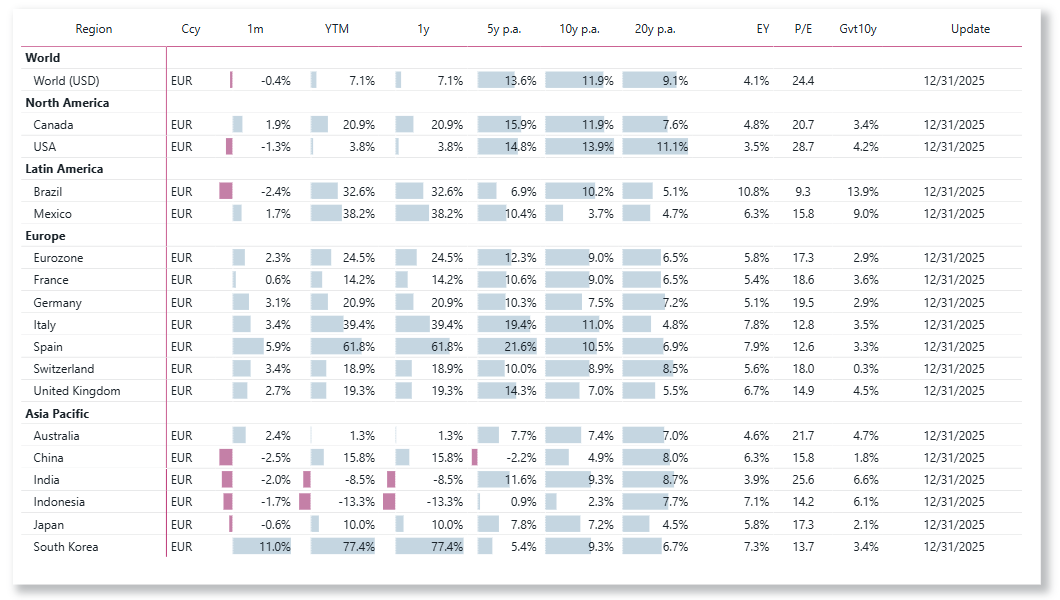

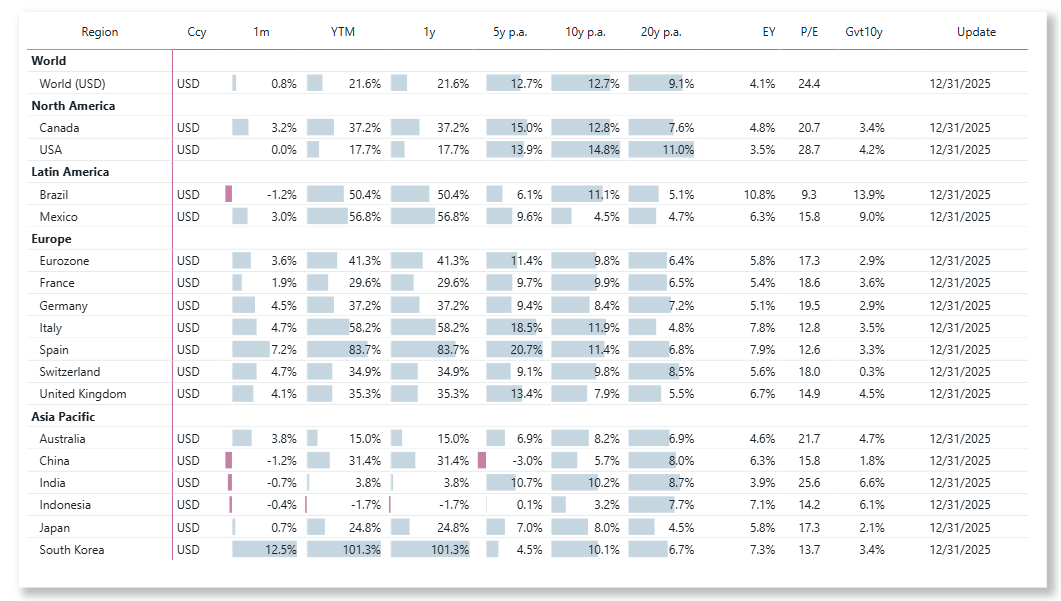

Global equity markets rose by 21.6% in 2025 when measured in US dollar terms. A significant portion of this performance was driven by the weakening of the US dollar. When expressed in EUR global equities gained only 7.1% and in CHF 6.2%.

Europe

European equity markets delivered a very strong performance in 2025, with the S&P Europe 350 recording its best annual result since 2021. The index rose by 21% over the year, outperforming the euro-based S&P 500 by a wide margin of 16 percentage points. Mid-cap stocks were particularly strong, as the S&P Europe MidCap advanced by 29%, its best performance since 2009. Small-cap equities lagged somewhat but still achieved a solid return of 15% in 2025.

Country allocation played a key role in performance, with the United Kingdom making the largest positive contribution thanks to its heavy index weighting and a 5% outperformance.

Spanish equities delivered an exceptional 62%, driven overwhelmingly by banks, which accounted for roughly two-thirds of the gains thanks to surging profitability, high dividends, and strong balance sheets. Additional support came from energy/utilities and select industrials, while Spain also benefited from a long-overdue valuation catch-up versus other European markets.

At the sector level, Financials stood out with an exceptional gain of 48%, marking their strongest year since 1998. Real Estate was the weakest-performing sector, narrowly remaining in positive territory, while the majority of sectors trailed the broader index over the year.

Fixed income markets delivered a comparatively subdued performance, with most government bond indices ending the year with only modest gains or slight losses. In contrast, corporate and high-yield bonds enjoyed a strong 2025, a result that many European bond managers would gladly welcome again in 2026.

North America

U.S. equity markets closed 2025 with solid double-digit returns for the third consecutive year, marking one of the fastest rebounds seen in recent history after coming close to bear-market levels in early April. Despite limited expectations for a year-end rally, the S&P 500 advanced by 18% and recorded 39 new all-time closing highs. This performance came against a challenging backdrop of geopolitical uncertainty, trade tensions, persistent inflation concerns, a temporary government shutdown, and signs of softening in the labor market.

The recovery was largely driven by continued strength in mega-cap stocks and sustained optimism surrounding artificial intelligence. Growing confidence that the Federal Reserve would begin easing monetary policy helped extend gains beyond large caps, supporting mid- and small-capitalization stocks as well. All major large-cap sectors finished the year in positive territory, with Communication Services and Information Technology leading the advance, rising by 34% and 24% respectively.

As expectations of Federal Reserve rate cuts pushed short-term Treasury yields lower, all fixed income indices delivered positive returns. Credit markets led the gains, with iBoxx Liquid Investment Grade and iBoxx Liquid High Yield outperforming government bond indices such as iBoxx Treasuries.

Latin America

In 2025, Latin American equities rebounded sharply after a weak 2024, with the MSCI Latin America index up around 55% in USD terms, well ahead of global markets. Brazil’s Ibovespa (+35.4% in local currency) and Mexico’s IPC (+31%) delivered strong gains, though performance remains highly sensitive to political, fiscal and currency developments.

Asia-Pacific

Equity performance across Pan-Asian markets varied widely in 2025. Measured in local currencies, South Korea clearly stood out as the strongest performer, with equities surging by 96%. Greater China delivered robust returns, led by gains of 31% in both Hong Kong and Taiwan, while mainland China rose by 26%. In contrast, several ASEAN markets underperformed, with equities in Thailand and the Philippines ending the year in negative territory. India recorded a more moderate increase of 9%, Indonesia advanced by 1.9%, Australia gained 6.6%, and Japanese equities posted a solid rise of 25%.

Fixed income markets across the region also generated positive returns overall. The iBoxx USD Asia-Pacific index, together with the local-currency iBoxx ABF Pan-Asia and ALBI indices, each advanced by around 8% in 2025. Chinese government and policy bank bonds lagged, finishing just above break-even after a strong performance the previous year. Japanese bonds moved against the global trend as the Bank of Japan continued to normalize monetary policy, with the S&P Japan Bond index declining by 6% as yields climbed to 1.99%.

Learn more on LCI Research

Equity Performance of selected Countries

Choose the performance be computed in local currency, CHF, EUR or USD

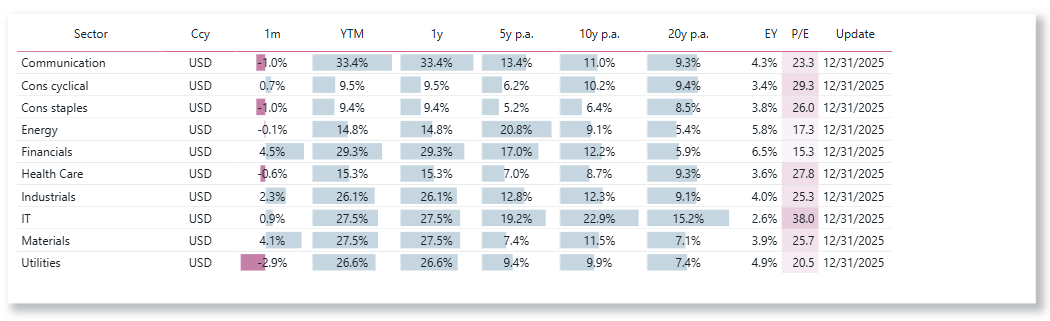

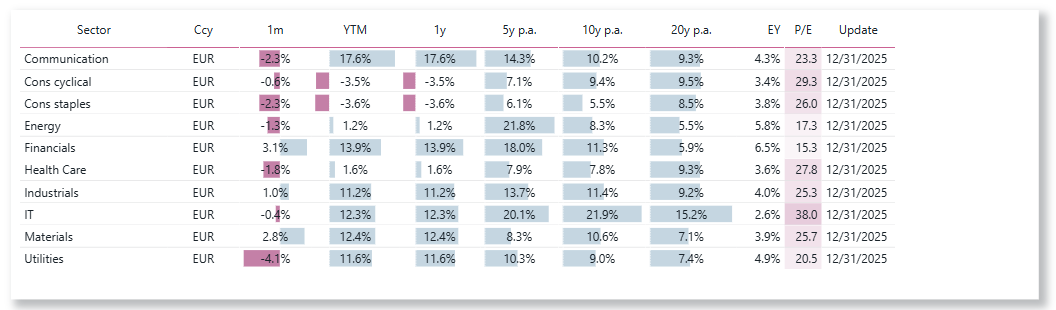

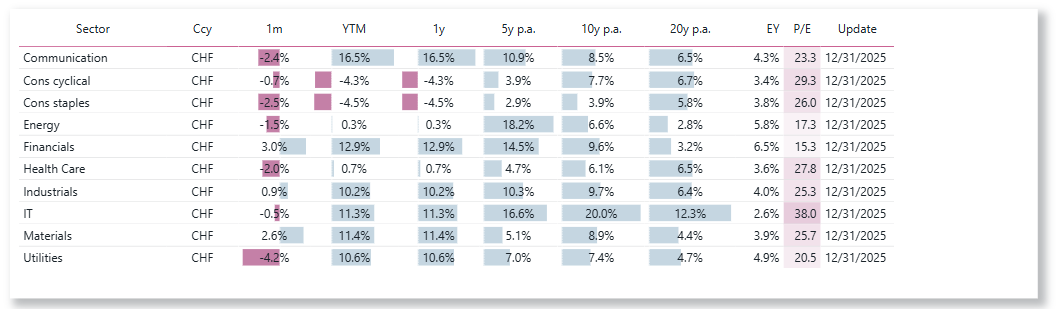

Equity Performance of Global Sectors

Choose the performance be computed in USD, EUR or CHF

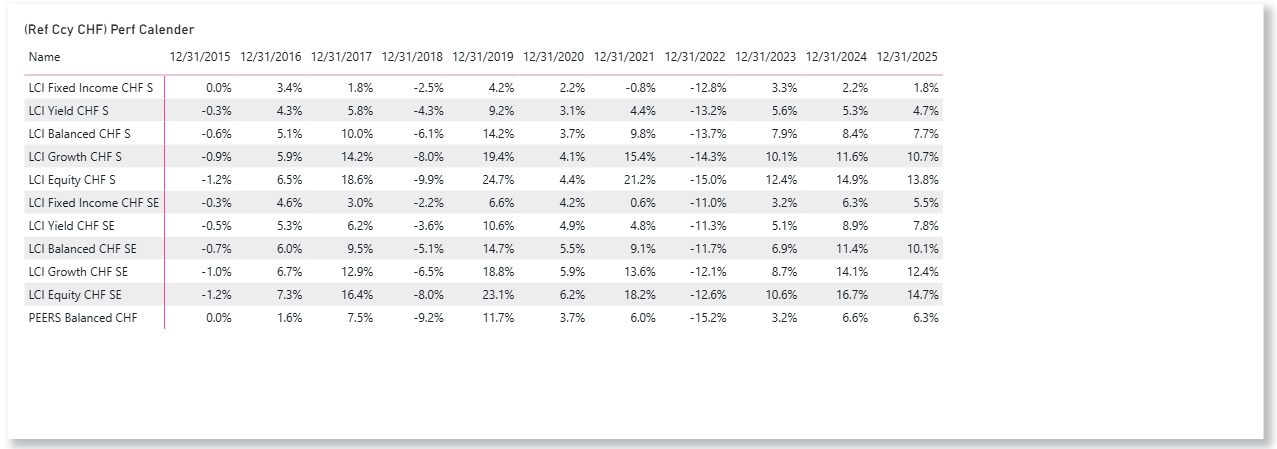

Learn more about LCI Strategies

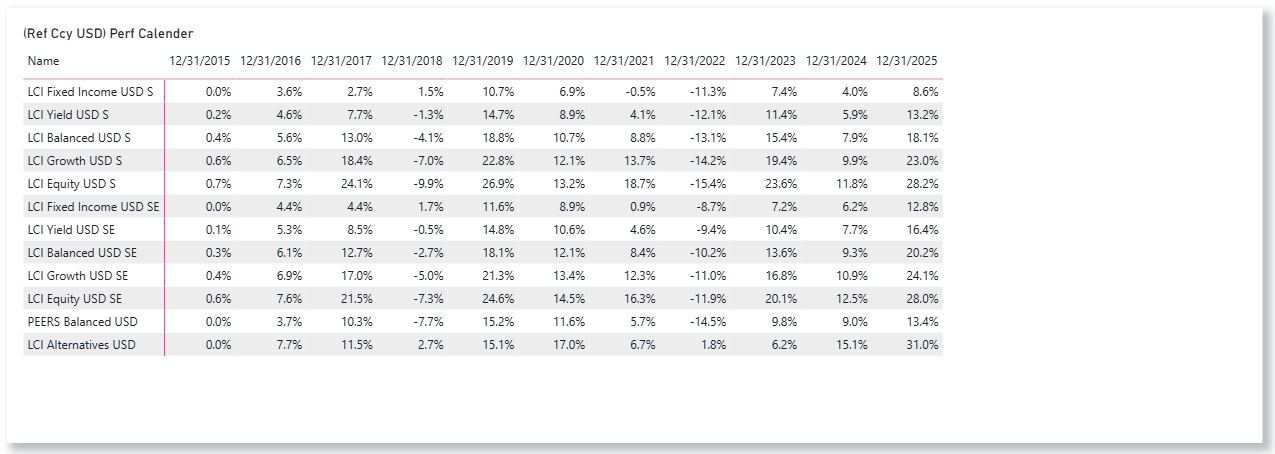

LCI Strategies Performance update

LCI Strategies in CHF, EUR and USD