Stratégies d’investissement sur mesure

Une vision. Une stratégie. Trente variations.

Parce que les investisseurs diffèrent — par leur appétit pour le risque, leur exposition aux devises et leurs préférences en matière d’investissement. Notre approche combine une stratégie unifiée avec une flexibilité adaptée en offrant :

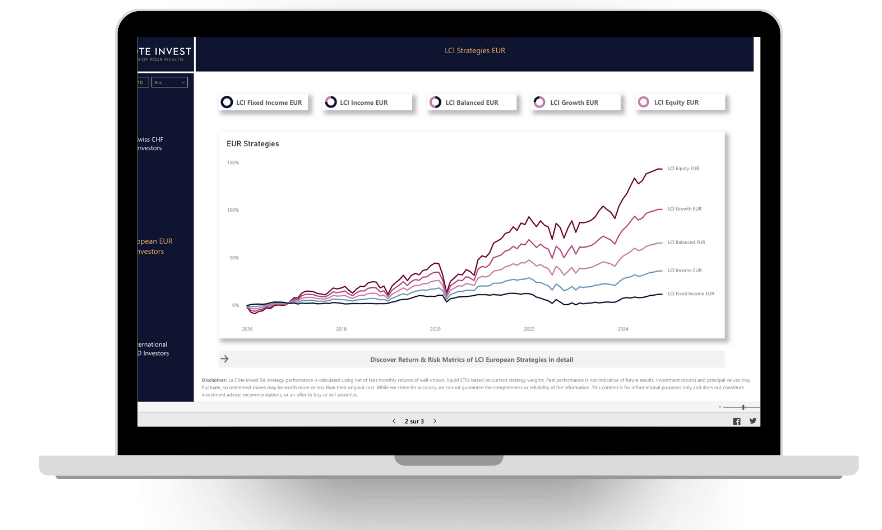

5 profils de risque – du conservateur à l’ambitieux. Tous les investisseurs ne perçoivent pas le risque de la même manière. Nos profils permettent d’aligner votre portefeuille avec votre tolérance au risque et vos objectifs d’investissement.

3 devises de référence – CHF, EUR et USD. Bien que tous les portefeuilles soient globalement diversifiés, nous adaptons chaque stratégie à votre devise de référence. Plus la stratégie est conservatrice, plus la part des actifs protégée contre les fluctuations de change est importante.

2 parcours – chaque stratégie existe sous deux formes :

S (Stratégie de base) – notre stratégie de base, offrant une allocation stable et de long terme entre obligations et actions. Elle est révisée chaque année pour refléter l’évolution de la capitalisation boursière mondiale, des conditions économiques et des tendances sociétales.

SE (Stratégie enrichie) – une version plus large et plus dynamique, intégrant les investissements alternatifs, l’immobilier, les métaux précieux, et permettant des ajustements tactiques tout au long de l’année.

Pourquoi proposer 30 variations d’une seule stratégie ?

Le choix dépend de votre volonté d’être plus proactif et de l’ampleur que vous souhaitez donner à votre portefeuille :

Vous privilégiez une allocation classique d’actions et d’obligations liquides avec une intervention minimale ? Alors S est probablement le meilleur choix.

Vous souhaitez accéder à un univers d’investissement plus large — incluant le private equity, les matières premières, les hedge funds, l’immobilier et les métaux précieux — et disposer d’une plus grande flexibilité pour ajuster vos allocations ? Alors SE peut vous convenir.

Bien qu’il n’existe aucune garantie qu’une stratégie plus active surperforme une approche passive, nos stratégies SE ont généré au cours des 10 dernières années des rendements ajustés du risque (ratio de Sharpe) supérieurs à ceux de leurs équivalents S — une tendance qui pourrait se poursuivre, même si les performances futures restent incertaines.

S ou SE – quelle option est faite pour vous ?

Combien de risque pouvez-vous assumer ?

Testez votre appétit pour le risque

“Achetez des obligations si vous voulez bien dormir, et achetez des actions si vous voulez bien manger”