Research & Insight

Key Drivers of Our Investment Strategy

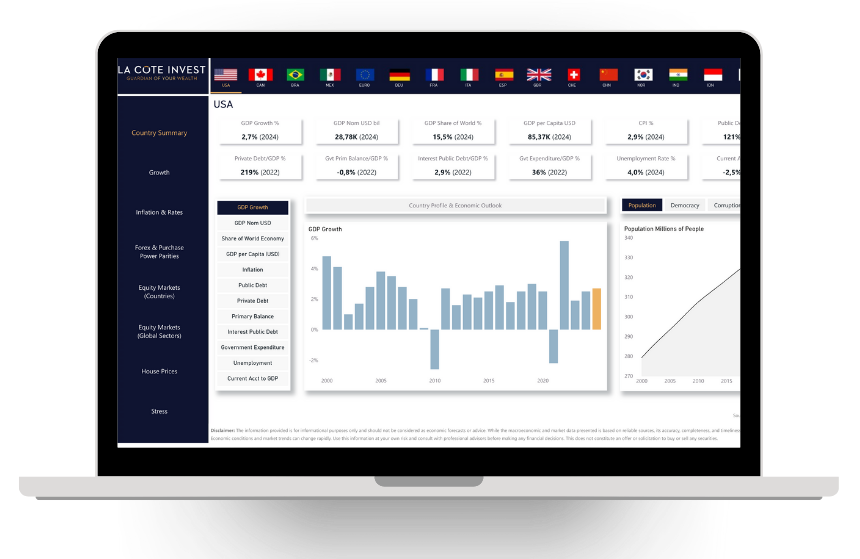

This page presents the main indicators guiding LCI’s current investment decisions. You will find:

-

Economic fundamentals for each country, along with a profile, map, and OECD economic outlook. We also track political and governance factors such as democracy, corruption, and competitiveness. This data is updated annually.ption text goes here

-

Key growth metrics including GDP growth, unemployment, productivity, and leading indicators like PMIs.

-

Consumer Price Indices (CPI), short- and long-term interest rates. From these, we derive real interest rates (nominal rates minus inflation) and the yield curve (spread between 10-year and 1-year government bonds), which helps assess an economy’s position in the business cycle.

-

We compare current exchange rates with long-term PPP values. PPP suggests that, over time, identical goods should cost the same across countries once exchange rates are adjusted.

Example: If a Big Mac costs $5 in the US and CHF 6 in Switzerland, the PPP exchange rate should be 1.20 CHF/USD. If the actual rate is 1.00, the Swiss franc may be overvalued. -

Country and sector performance, earnings growth, earnings yield, P/E ratios, and equity risk premiums.

-

Nominal and inflation-adjusted house prices across countries.

-

Measures of financial stress including volatility indices, credit spreads, and gold prices.